But analysts say the decision to sell out was mainly prompted by their long-term poor performance

Accusations by the US House Select Committee that BlackRock was profiting from investments that help the Chinese military were followed by significant outflows in four of the named funds, Morningstar data for August shows.

Four out of the five BlackRock funds highlighted by the committee experienced outflows in August, with three of them witnessing a significant drop in net flows, according to Morningstar data.

The $21.6bn iShares MSCI Emerging Markets exchange traded fund saw the largest outflows, bleeding $1.9bn in August, followed by outflows of $89mn from the $7.6bn iShares MSCI China ETF.

The $290mn iShares MSCI China A ETF had outflows of $14mn, while a net $2mn in cash leFW the $17mn BlackRock China A Opportunities Fund.

The iShares MSCI China ETF, iShares MSCI China A ETF and BlackRock China A Opportunities Fund lost 4.27 per cent, 7.97 per cent and minus 5.4 per cent over the year to August 30 respectively, according to Morningstar data.

These funds have investments in 20 Chinese companies that have been identified by the committee as “posing national security risks and acting against US interests”.

US lawmakers subsequently sent letters to the US funds giant in early August, requesting explanations regarding their holdings in these blacklisted Chinese firms.

However, analysts argue that the outflows were not necessarily driven by political concerns.

Jeff Tjornehoj, US-based senior director of fund insights at Broadridge, noted that flows to ETFs with a focus on the China region have been negative in four of the past five months, suggesting the outflows were more a consequence of the result of “poor performance” in Chinese equities.

However, he acknowledged that some investors could “shy away” from those funds to “avoid controversy”.

Bryan Armour, director of passive strategies research for North America at Morningstar, said some investors did choose to sell shares in response to the investigation, but he would not expect the letter to have a “large impact” on the investing community.

The increasing number of “cracks appearing in China’s economy” was a “larger catalyst” for the outflows, he argued.

“Many investors piled into China and emerging markets funds when China began to reopen its economy and remove Covid-related restrictions at the beginning of this year,” he said.

“As growth targets missed the mark and risks increased, it is reasonable to expect investors to lose interest in the China-reopening trade, especially as developed markets outpaced emerging ones,” he added.

Gerard DeBenedetto, partner at Tan Lane Holdings Limited, agreed, saying that investors pulled money out as “the risk profile for Chinese stocks has changed”.

“Allocators and investors are not immune from the constant headlines of China trade, property and demographics,” he said.

BlackRock recently shut down a Luxembourg-domiciled China equities fund due to “lack of new investor interest” amid China’s faltering economic recovery and an ongoing slowdown in mainland stocks.

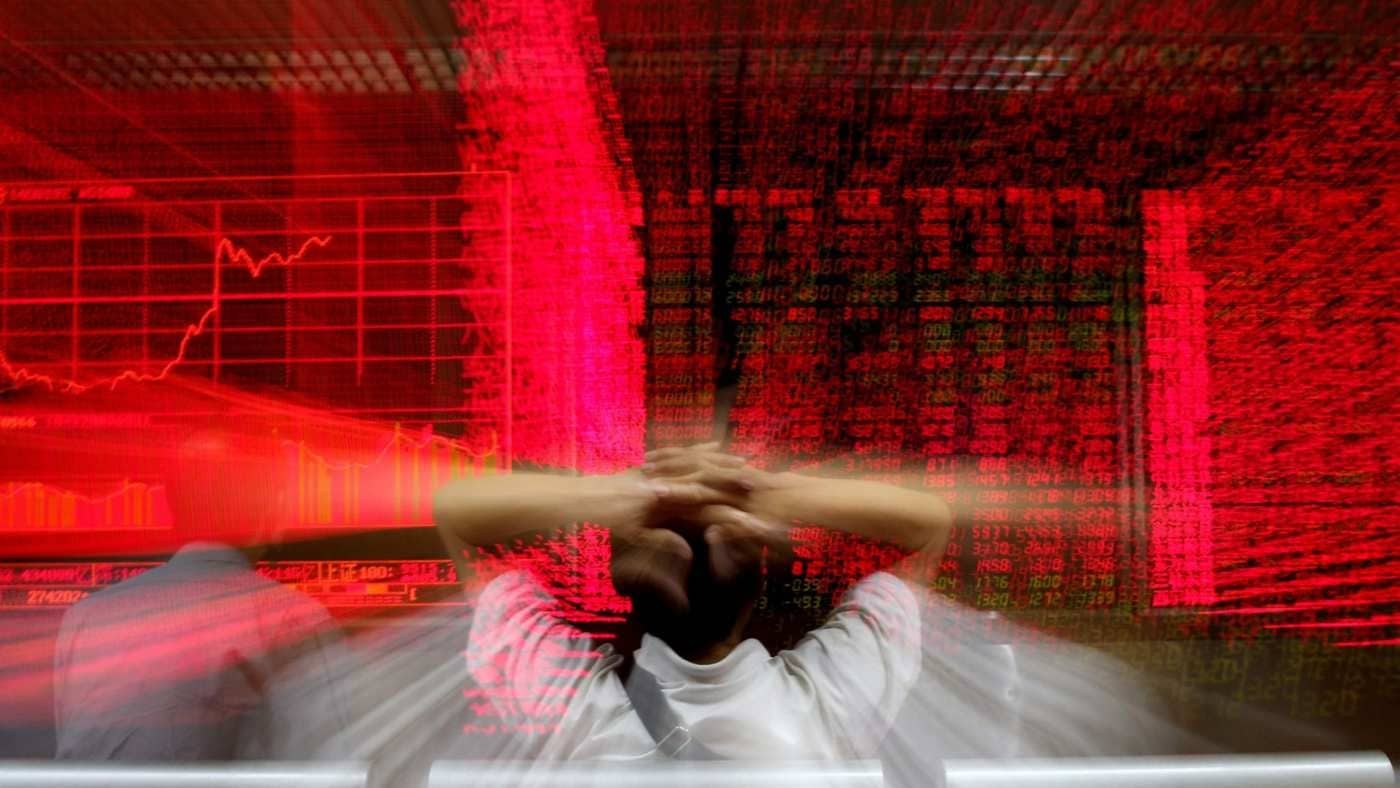

The ongoing stock market volatility and underperformance of equities funds in the market have led to a significant reduction in investor risk appetite for China-focused stock strategies in many markets.

Mutual funds focused on China saw $647mn in outflows in the second quarter of this year, compared with net inflows of $1bn into emerging markets ex-China strategies, and the 10 largest China-focused mutual funds have seen their assets shrink by 40 per cent since 2021.

Global emerging market funds with exposure to China equities have also been shiFWing away from China, with the average China exposure among 1,048 actively managed global emerging market equities funds falling by 3.2 percentage points to 24.7 per cent in the first seven months of this year.

There are some managers who remain optimistic about the China market, however, citing low valuations and the long-term opportunities in the growing wealth of Chinese consumers.

Jonathan Krane, founder and chief executive of KraneShares, said China funds and investments had been “oversold” due to geopolitics, not fundamentals.

He believed that US investors are beginning to see a “real buying opportunity” in China.

“Investors are recognising the opportunity following positive developments around economic stimulus measures and stock market reforms in China,” Krane said.

“Chinese consumers continue to grow wealthier and offer a long-term, strategic investment growth opportunity,” he said.

He added that communications between the US and China had “increased dramatically”, with four state visits by the US in just the past three months, which “should help improve sentiment”.

Franklin Templeton president and chief executive Jenny Johnson also expressed enthusiasm for China’s innovation-focused sectors this week at a conference in Singapore.

She said the current bearish sentiment around China was “probably overhyped”, with the Chinese economy set to “rubber band back up” eventually.

*Ignites Asia is a news service published by FW Specialist for professionals working in the asset management industry. Trials and subscriptions are available at ignitesasia.com.

Source: Financial Times