UK labour market appears an outlier compared with the US and the EU

In the space of 10 days, three major central banks have made policy decisions that all seemed so finely balanced that they could have gone either way. The Federal Reserve unanimously chose last week to hold its policy rate unchanged — but went out of its way to suggest it may raise rates again at its next meeting. The Bank of England also stayed its hand, but with the voting split nearly down the middle, and observers increasingly thinking the peak may have been reached. The previous week, the European Central Bank raised rates, despite weakening economic growth.

The deepening uncertainty around what monetary policymakers were going to do is not hard to understand: it is linked to deepening uncertainty about what they ought to do. We have entered a time when the signals from both price movements and economic activity are becoming harder to read. That increases the scope for error — and the chance that the major central banks will diverge after tightening in parallel for more than a year.

Another reason for divergence has gone more unnoticed. As supply-side drivers of inflation — from pandemic dislocations to Russia’s energy and commodity price wars — have waned, the main price risks are now domestic. Central bankers are homing in on wage growth which, if it remains high, could prevent services and core inflation from following the headline rate down.

Wage growth has behaved in different ways. US hourly earnings have come down from a peak 6 per cent annualised growth rate to stay in a 4-5 per cent range throughout this year. This is too high to be consistent with 2 per cent inflation — if it is sustained. So the big question for the Fed is whether wage growth is reacting to past inflation to make up for real wage erosion — in which case it may moderate again as headline price growth keeps falling — or whether workers see this rate of nominal pay rises as a new floor that they will insist on keeping.

In the eurozone, wages are often negotiated by collective bargaining, not set in markets. That makes for a greater lag in response to price inflation, and the ECB’s indicator of negotiated pay growth bounced up this year after being subdued. President Christine Lagarde’s comments on the last rate rise made clear that these developments are central to the ECB’s hawkishness.

This contrast highlights two important things. One is that because labour relations differ markedly between economies, so does wage formation and its influence on inflation. If wages are the most important factor, expect to see central banks behave differently.

Second, labour markets are inherently political, as the ongoing United Auto Workers strikes in the US illustrate. That makes them harder for central banks to predict, and more delicate to influence. Wage negotiations are, after all, a power struggle between workers and capital owners. The ECB has been particularly clear about the two sides of this equation, its officials often highlighting that the inflation outlook also depends on businesses’ willingness to let high profit margins absorb temporarily high wage growth.

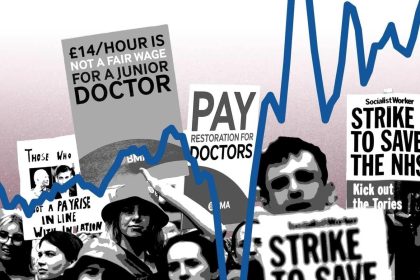

In all these regards, the UK is an outlier — and not in a good way. Its nominal wages are rising much faster than in the two larger economies. Year-on-year growth in regular pay has now accelerated to 7.8 per cent, well above price inflation. And when the BoE has commented publicly on wages, it has at times come out sounding like a class warrior on the side of capital. With tempers high in UK labour markets, it must communicate better, lest it inflames labour conflicts further. But whatever the local wage process, all CBs need pay growth set on a glide path to levels consistent with their inflation targets.

Source: Financial Times